“HERE ARE THE MOST PROMISING CRYPTOCURRENCY THAT WILL EXPLODE IN 2025!”

*Clickable logo links to visit their official websites* *Disclaimer: not sponsored by any cryptocurrency mentioned here, do your due diligence & research*

Table of Content for Cryptocurrency

1. BITCOIN (BTC)

Market Capital: $2 trillion

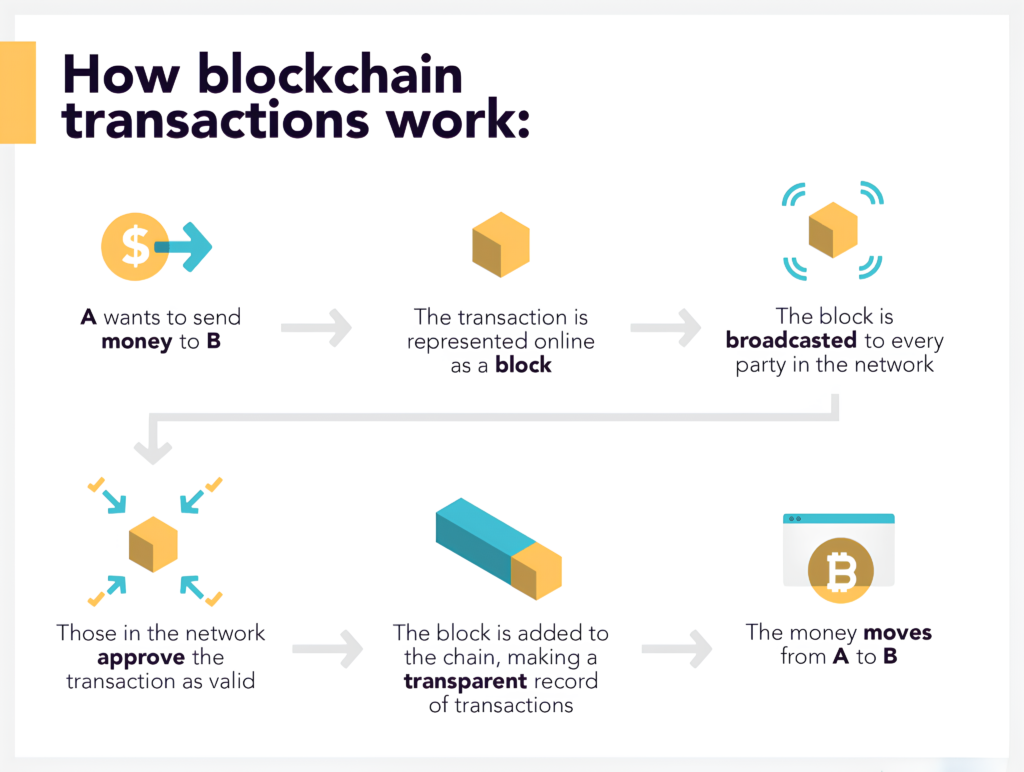

Bitcoin known as the “Father of Cryptocurrencies”, was the first original cryptocurrency created by an anonymous figure Satoshi Nakamoto! Bitcoin led to the creation of blockchain technology. It has changed the financial industry and started a new era of decentralized transactions.

People recognize Bitcoin for its strong security. Because of its wide use and recognition, Bitcoin is the top choice for cryptocurrency investments.

HERE’S WHAT MAKES 𝗕𝗜𝗧𝗖𝗢𝗜𝗡 SPECIAL!🧐

Decentralized Network: Bitcoin operates on a network not controlled by any single entity (government, bank, etc.). This gives individuals more control over their finances.

Empowerment: Bitcoin, known as “The People’s Money,” gives users more control over their money than banks do. Banks can freeze or block traditional bank accounts.

Security: Bitcoin transactions are secured by blockchain technology, offering a potentially more secure alternative to traditional systems.

𝗪𝗛𝗬 𝗖𝗛𝗢𝗢𝗦𝗘 𝗕𝗜𝗧𝗖𝗢𝗜𝗡?𝗕𝗘𝗖𝗔𝗨𝗦𝗘 ITS FOOLISH 𝗡𝗢𝗧 TO.

Countries like El Salvador and the Central African Republic have adopted Bitcoin as their official currency for legal tender.

Many large companies, like Microsoft, Wikipedia, Ferrari, DELL, Starbucks, and Express VPN, now accept Bitcoin. Twitch and thousands of other businesses also accept it as a payment method.

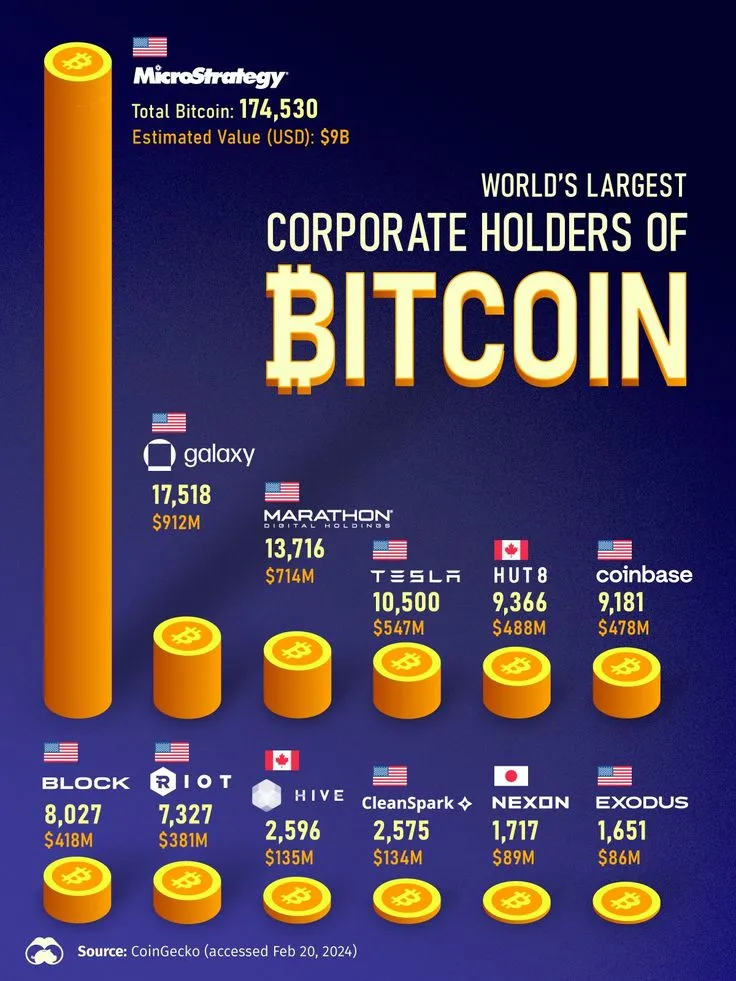

Recently, authorities approved Bitcoin for an ETF. Large financial institutions like Blackrock, Fidelity Investments, and Grayscale are now offering Bitcoin ETFs.

President Donald Trump has already established Strategic bitcoin reserve like the traditional reserve assets like gold. Trump has previously stated that he wants the US to become the “crypto capital of the world”. Trump’s actions hinted at an acknowledgement of Bitcoin’s growing acceptance.

Bitcoin is considered the most ideal investment for those looking to cryptocurrency. With its wide use and trust, plus a recent halving event, Bitcoin looks promising. It looks promising, with experts projecting its value to exceed $100,000 per Bitcoin by 2030. I recommended you to have Bitcoin as your highest holding in your portfolio for smarter & safer investment.

2. ETHEREUM (ETH)

Market Capital: $356 billion

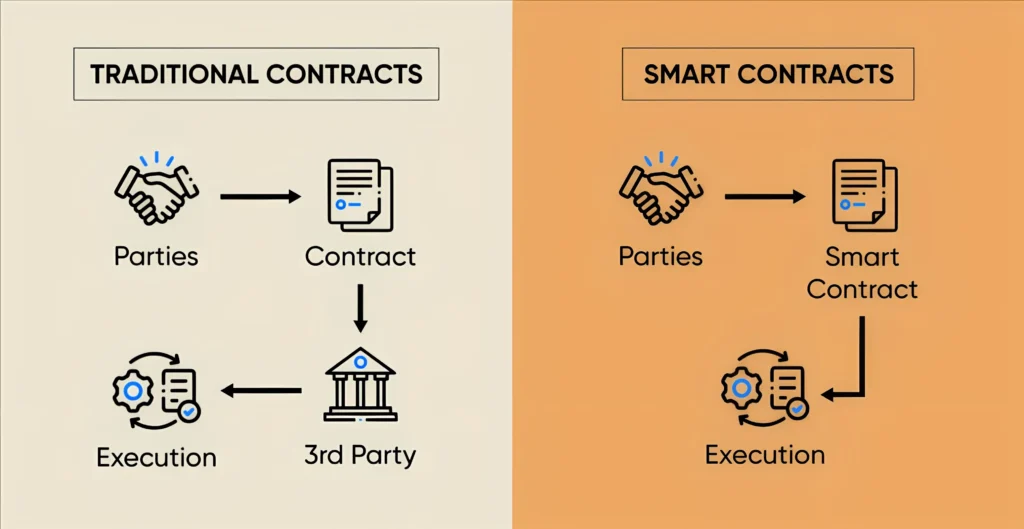

Ethereum is called the “Mother of Altcoins” as it birthed many significant cryptocurrencies. Vitalik Buterin founded it on July 30, 2015, and helped expand its use by introducing smart contracts. Smart contracts allow the creation of Decentralized Apps (DApps) and NFTs by working on their own without needing third parties.

WHY 𝗘𝗧𝗛𝗘𝗥𝗘𝗨𝗠 IS A 𝗕𝗜𝗚 THING!🚀

Platform for Innovation: Ethereum acts as a platform for various sectors to leverage blockchain technology. This includes Decentralized Finance (DeFi), Decentralized Applications (DApps), Gaming & Metaverse, Healthcare, and more

Backbone of Altcoins: Ethereum is the foundation for many altcoins. Developers build these cryptocurrencies on the Ethereum network.. Some notable examples include USDT, USDC, Uniswap, and Polygon Matic.

Ethereum 2.0 (Serenity): This ongoing development aims to improve the Growth and long-term use of the Ethereum network

𝗦𝗠𝗔𝗥𝗧 𝗖𝗢𝗡𝗧𝗥𝗔𝗖𝗧𝗦 𝗘𝗫𝗣𝗟𝗔𝗜𝗡𝗘𝗗 𝗔𝗧 𝗔 𝗖𝗛𝗜𝗟𝗗’𝗦 𝗟𝗘𝗩𝗘𝗟📜 🧩

Automatic actions: When the conditions you set are met (like putting in the money), the code runs automatically, without needing anyone else involved.

Trust & Transparency: Everyone can see the agreement and how it works, reducing the risk of cheating.

Faster & Cheaper: No middleman means potentially lower fees and quicker execution.

Secure & Unchangeable: The code is super secure and can’t be tampered with once it’s on the blockchain.

In conclusion, Ethereum is my second top investment recommendation and also my second-largest holding. It serves as a powerful platform for a vast ecosystem, and its growth potential is immense. Many speculate that Ethereum could grow tenfold in the near future.

3. POLYGON (POL)

• Market Capital: $$970.33 million

Polygon, formerly recognized as Matic Network, is an Indian-based cryptocurrency project established in 2017. It functions as a layer 2 scaling solution for the Ethereum network. Layer 2 (off-chain) projects are built upon existing projects called layer 1(on-chain) such as Ethereum, Solana, and Polkadot.

𝗪𝗛𝗔𝗧 𝗜𝗦 𝗣𝗢𝗟𝗬𝗚𝗢𝗡? 𝗟𝗘𝗧’𝗦 𝗗𝗜𝗩𝗘 𝗗𝗘𝗘𝗣𝗘𝗥!

Features :

Ethereum Layer 1 Foundation: Polygon is built on Ethereum’s blockchain, benefiting from its security while enhancing speed and scalability, and is not controlled by any single person or company

Faster Transactions: Polygon significantly reduces transaction time, providing a much quicker user experience compared to Ethereum’s slower transaction speeds.

Lower Gas Fees: Polygon offers much lower transaction fees than Ethereum, making it more cost-effective for users to conduct crypto transactions.

High Transaction : With the ability to process thousands of transactions per second, Polygon solves Ethereum’s scalability issues, making it more efficient for high-volume use cases.

zkEVM (Zero-Knowledge Ethereum Virtual Machine): The zkEVM feature enables Polygon to offer Ethereum-compatible transactions with zk-Rollups, enhancing scalability, privacy, and reducing transaction costs while maintaining security and decentralization.

In simpler terms, Polygon is constructed on the foundation of the Ethereum blockchain (Layer 1) to optimize its speed and efficiency. This optimization results in quicker transactions and reduced transaction gas fees. It can also handle thousands of transactions as compared to Ethereum.

Polygon Matic is a great project backed by an excellent development team with a solid background, which is why it is one of my favourite altcoins to invest in this year. It has great potential ranging from Web 3 to DeFi and another vast ecosystem. I prefer using Polygon Network for my crypto transactions because of cheaper fees and fast transactions.

In conclusion, Matic has huge potential to give a high return on investment (ROI) due to its amazing real-time practical utility.

4. AVALANCHE (AVAX)

• Market Capital: $16.38 billion

Avalanche, developed by Ava Labs, is a blockchain platform, a tough competitor of Ethereum it aims to be faster and cheaper than Ethereum, serving as a foundation for various decentralized applications (DApps), decentralized finance (DeFi) solutions, and other blockchain-based projects. It excels at executing smart contracts, facilitating seamless processes without the need for a third party.

INTRODUCING 𝗔𝗩𝗔𝗟𝗔𝗡𝗖𝗛𝗘! CREATING WITHOUT LIMITS!🎈

Avalanche Consensus Protocol: Avalanche uses Avalanche Consensus protocol, which enables high transaction throughput, rapid confirmation times, and low transaction fees.

Industry Partnerships: Strategic collaborations with major corporations, including Amazon Web Services (AWS), MasterCard, and JP Morgan, strengthen Avalanche’s credibility and influence in the blockchain space.

DeFi Platforms: Avalanche provides a high-performance, low-cost for DeFi platforms like decentralized exchanges, lending protocols, and stablecoin projects. Its fast transaction speeds and scalability ensure smooth and efficient financial operations.

dApp Development: Avalanche allows developers to create and deploy dApps seamlessly, benefiting from lower fees and faster processing. This makes it an appealing option for building various decentralized applications, including NFT marketplaces and gaming platforms.

In conclusion, Avalanche stands as a promising investment opportunity due to its strong potential for growth. With its ongoing development in the realms of DApps, DeFi, and Web3 applications, Avalanche appears to play a pivotal role in the future of blockchain technology.

5. Polkadot (DOT)

• Market capital: $11.4 billion

Polkadot is a blockchain platform and cryptocurrency. It was created by Gavin Wood, a co-founder of Ethereum. The Web3 Foundation developed it.

The native cryptocurrency for the Polkadot blockchain is known as DOT. Its primary purpose is to enable secure communication and transactions between different blockchains without relying on a trusted third-party.

INTRODUCING 𝗣𝗢𝗟𝗞𝗔𝗗𝗢𝗧! CONNECTING ALL THE CRYPTO DOTS!

Connect Blockchains: It allows different blockchains to communicate with each other and share information or assets, making them work together.

Handle More Transactions: Polkadot can process many transactions at once by using parachain (parallel chain), making it faster and more scalable than older blockchains.

Decentralized Control: People who hold Polkadot’s native token, DOT, can vote on changes to the network, such as upgrades or how the platform should evolve.

Provide Shared Security: Smaller blockchains can use Polkadot’s main chain called relay chain for security, so they don’t need to worry about building their own security systems

HOW POLKADOT WORKS!💡👷♂️🔧

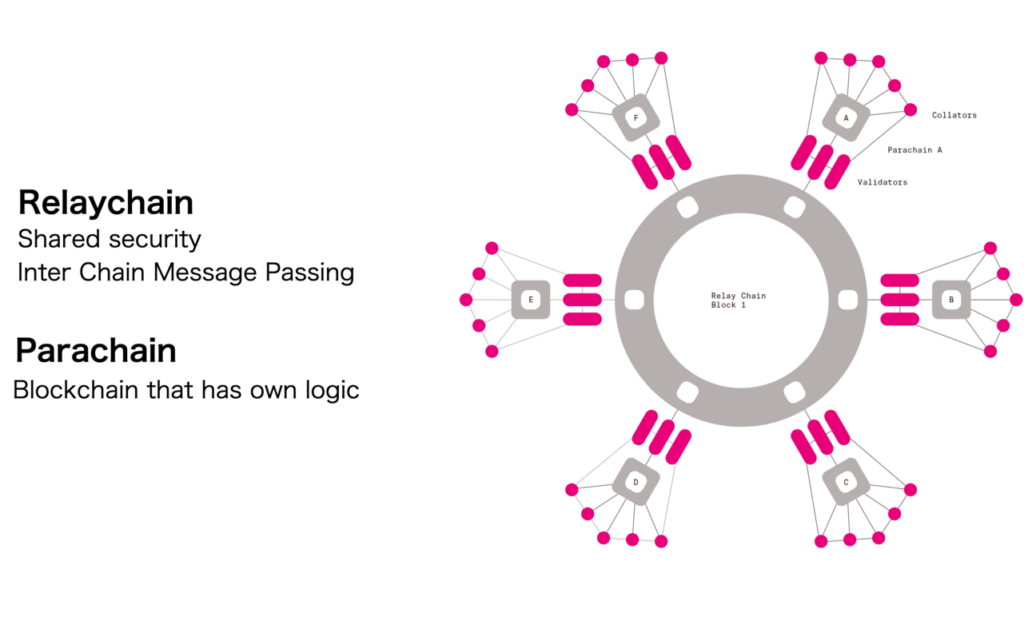

If you want to understand Polkdadot you have to know how Relay Chain and Parachain functions. It’s very simple!

Relay Chain (The Heart of Polkadot).

The Relay Chain is the main chain of Polkadot. Think of it as the main hub that connects and coordinates all the other blockchains, called parachains, in the Polkadot network.

Parachains (Independent Blockchains on Polkadot)

Parachains are custom individual blockchains that run within the Polkadot network. Each parachain can have its own features, rules, and governance. However, they all depend on the Relay Chain for security and agreement.

In simpler words Relay Chain in the main chain that controls all the other chains in the polkadot ecosystem.

In simpler terms, parachains are independent blockchains. For example, when we create a blockchain, we can connect it to Polkadot as a parachain. This way, we can depend on the Relay Chain for security and compatibility.

Polkadot operates as a multi-chain network, allowing separate blockchains to work together smoothly. This interoperability facilitates the development of various applications, including cryptocurrencies, apps, and websites that can work within the Polkadot ecosystem. Some well known projects under polkadot ecosystem are Chainlink, Kasuama, Acala, Moonbeam, Bitfrost.

Polkadot is a solid project that I think is worth investing in. It aligns well with the growth of Web 3.0, which is the future trend. Web3 is the decentralized evolution from Web2 which we are currently using!

6. Litecoin (LTC)

• Market Capital: $6.1 billion

Litecoin, often called the “Silver to Bitcoin’s gold,” has been around for a long time. Bitcoin inspired it. It stands as one of the earliest Altcoins, launched in 2011 by Charlie Lee.

𝗟𝗜𝗧𝗘𝗖𝗢𝗜𝗡 IS LIKE BITCOIN BUT FASTER!

Decentralized P2P Cryptocurrency: Litecoin operates as a peer-to-peer decentralized currency, similar to Bitcoin, with modifications for faster transactions and lower fees.

Trusted Investment: It is considered more secure and reliable compared to many other altcoins, thanks to its long-standing presence in the crypto market.

Resilient Performance: Litecoin has proven it can survive tough bear markets and sudden drops. It has kept user trust over the years.

Simplicity and Reliability: Despite lacking flashy or innovative projects, Litecoin remains a solid investment choice due to its straightforward approach and consistent reliability.

GREAT FEATURES OF LITECOIN.

Litecoin Core

Litecoin enables instant payments to anyone, anywhere in the world using peer-to-peer technology without a central authority. The management and processing of these transactions is carried out collectively by the decentralized Litecoin network.

LIGHTNING NETWORK

The Lightning Network is a 2nd layer solution. Micropayments on the Lightning Network are guided by smart contracts; sets of rules that must be followed for transactions to take place. The fees are likely to be very small compared to the fees charged by miners on the main blockchain. The work done by Lightning Network nodes are far easier than that done by miners.

Litecoin is a decentralized peer-to-peer (P2P) cryptocurrency. It is like Bitcoin but has some changes. These changes allow for faster transactions and lower fees.

Many people often view Litecoin as a more secure investment compared to other altcoins, similar to Bitcoin. This trust stems from its longevity, reliability, and the confidence users have built over time. This resilience has allowed Litecoin to withstand harsh bear market and sudden crashes.

In conclusion, Litecoin may not have flashy or very new projects like some other altcoins. However, it is still a good investment choice. Its simplicity and reliability can help it last longer than many other altcoins.

7. Aave (AAVE)

• Market Capital: $5.4 billion

Aave is a decentralized finance (DeFi) platform that allows people to lend and borrow funds. Stani Kulechov founded it in 2017 while he was still a law student. The creators originally called Aave ETHLend and raised $16.2 million in an Initial Coin Offering (ICO).

MOST INNOVATIVE DeFi PROJECT!👻

Decentralized Lending Platform: Aave functions like a digital bank on the internet.

Lending: Users can lend their cryptocurrency and earn interest.

Borrowing: Users can borrow cryptocurrency by providing their own cryptocurrency as collateral.

Smart Contracts: Transactions are secured and automated using smart contracts, eliminating the need for traditional banks.

Aave is like a digital bank on the internet. It lets people lend their cryptocurrency to others and earn interest in return.

You can borrow cryptocurrency from Aave by using your own cryptocurrency as collateral. This means you promise to return it. Aave uses smart contracts to make sure everything happens securely without the need for a traditional bank.

In conclusion, DeFi is revolutionary. It can change traditional financial institutions like banks. DeFi promotes transparency and gives people more control over their money. For these reasons, I believe Aave is one of the best DeFi projects to invest in.

8. RENDER NETWORK(RNDR)

• Market Capital: $4.32 billion

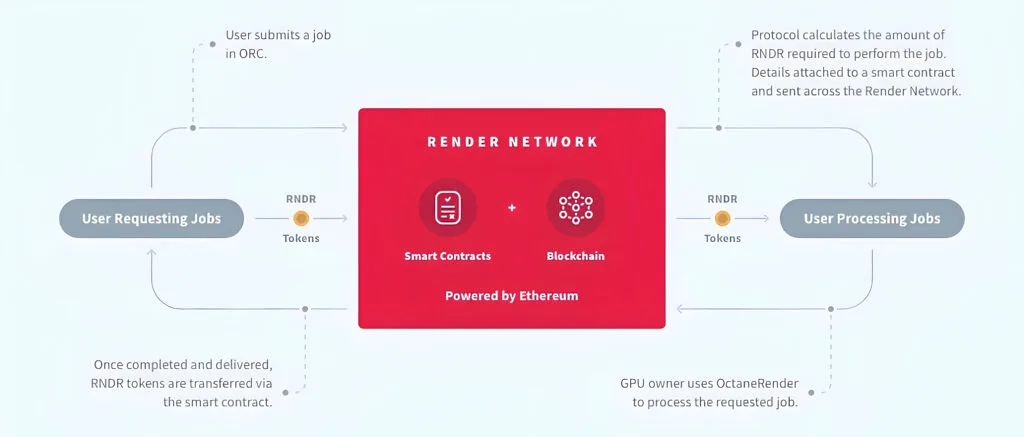

The Render Network is the first decentralized GPU rendering platform in the world. It helps artists scale their GPU rendering work on-demand for high performance globally.

INTRODUCING 𝗥𝗘𝗡𝗗𝗘𝗥 𝗡𝗘𝗧𝗪𝗢𝗥𝗞 ! THE REVOLUTIONARY AI PROJECT!🎈

Distributed GPU Rendering: Render Network is a decentralized GPU rendering system on the Ethereum blockchain.

GPU Contribution: Users can contribute GPU power through their computers’ graphic cards to render motion graphics and visual effects

Rewards: Contributors earn Render Tokens (RNDR), the network’s native utility token, in exchange.

AI Integration: Render leverages AI for animation, VFX rendering, and motion graphics.

Metaverse Support: It facilitates the creation of metaverse-based projects.

Render Network is a distributed GPU rendering network built on the Ethereum blockchain. It lets users like us share GPU power from our computers.

We use graphic cards (GPUs) to help projects create motion graphics and visual effects. In exchange, we earn a Render token (RNDR), the native utility token of the Render Network.

Render is one of the best crypto projects that uses Artificial Intelligence (AI). AI is important for animation, VFX rendering, and motion graphics. Render also helps in creating projects for the metaverse.

In conclusion, Render Network is unique. It is the first to decentralize GPU rendering services. Given its potential, Render Network is a great investment choice.

9. Chainlink (LINK)

• Market Capital: $7.8 billion

Sergey Nazarov and Steve Ellis created Chainlink in 2017. It is a decentralized oracle network built mainly on the Ethereum platform.

This network acts as a crucial bridge between smart contracts and real-world data, such as weather conditions or asset prices. Its role is to make sure that the data used by smart contracts is reliable. This makes Chainlink a unique project with great potential in the blockchain world.

𝗟𝗜𝗧𝗘𝗖𝗢𝗜𝗡 IS LIKE BITCOIN BUT FASTER!

Real-World Data Provider: Chainlink supplies reliable real-world data to the cryptocurrency industry.

Smart Contract Integration: It enhances smart contract functionality by eliminating the need for third-party intermediaries.

Use Cases: Chainlink is essential for cryptocurrency applications, decentralized finance (DeFi), supply chain management, and more.

Broad Impact: Its role extends beyond cryptocurrency, influencing diverse industries reliant on decentralized solutions.

The cryptocurrency industry needs reliable real-world data. Many crypto projects use smart contracts to remove the need for third-party middle-men. Chainlink plays a significant role in advancing smart contract technology by providing this vital real-world data.

Chainlink will be important not just for cryptocurrencies. It will also help in decentralized finance (DeFi) and supply chain management.

In conclusion, Chainlink has great potential for growth in the next bull market. It is likely to be a top cryptocurrency in the future. Therefore, I recommend holding some Link tokens.

10. Arweave (AR)

• Market Capital: $2.55 billion

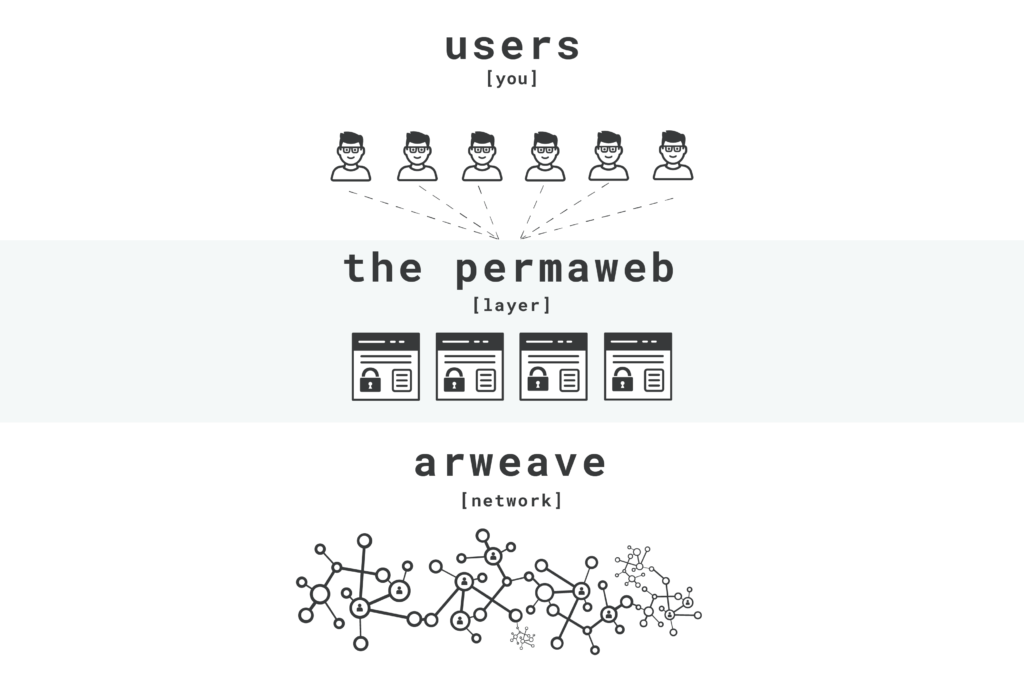

Arweave is the World’s first decentralized network that uses blockchain technology to enable permanent data storage. Sam Williams and William Jones founded Arweave as a start-up Archana in early 2017.

Its design lets anyone keep data forever with a one-time fee in a system called permaweb. Its native token is AR, this token encourages miners to participate in the network, further strengthening data permanence.

WHY ARWEAVE IS REVOLUTIONARY!

Permaweb: Enables permanent data storage with a one-time fee through its innovative permaweb system.

Native Token (AR): AR token incentivizes miners, ensuring data permanence on the network.

Wide Applications: Supports use cases in Web 3.0, decentralized finance (DeFi), healthcare data management, academic research, and more.

Future-Ready Storage: Ensures long-term data availability for future generations.

Censorship Resistance: Protects against government censorship and data loss.

As Arweave grows, many areas can use it. These include Web 3.0, decentralized finance (DeFi), healthcare data management, and academic research.

It allows users to store and access information. This ensures it is available for future generations. It also protects against government censorship and data loss.

In conclusion, Arweave is a unique project with great potential. It can help not just in the crypto industry but also in many other areas. Everywhere, we need a permanent data storage solution, starting with our personal documents and photos. Arweave is one of the promising storage-based projects I have been investing in for a long time.

Disclaimer: The content on CryptoGrandyssey is for informational and educational purposes only and should not be considered financial, investment, or legal advice. While we strive to recommend and share insights about promising cryptocurrency projects, we do not guarantee the information’s accuracy, completeness, or reliability.

Cryptocurrency investments carry significant risk, and you should conduct your research (DYOR) and consult a qualified financial advisor before making any investment decisions. CryptoGrandyssey is not responsible for any financial losses incurred based on the information provided on this platform. Invest wisely, and only risk what you can afford to lose